Islamabad: The Pakistani government may need to cut development expenditures, implement revenue-enhancing measures, and enforce strict fiscal controls in the last quarter of the current financial year before securing the next $1.1 billion tranche from the International Monetary Fund (IMF).

According to sources, the new financial measures set to take effect from April 1 will follow a three-pronged approach. This includes strict control over the Public Sector Development Program (PSDP), increased tax collection from the retail and real estate sectors, and emergency fiscal adjustments under the $7 billion Extended Fund Facility (EFF) to bridge revenue shortfalls.

Authorities estimate that these steps could help cover a fiscal deficit of PKR 600 billion recorded over the past eight months. However, if business continues as usual, the shortfall may exceed PKR 1 trillion by the end of the fiscal year.

An official emphasized that while some adjustments may be made for lower-than-expected inflation and trade realities, the government must now translate its reform commitments into concrete financial figures rather than mere discussions. The Federal Board of Revenue (FBR) has pledged to generate PKR 250 billion in additional revenue from retailers and a significant amount from the real estate sector.

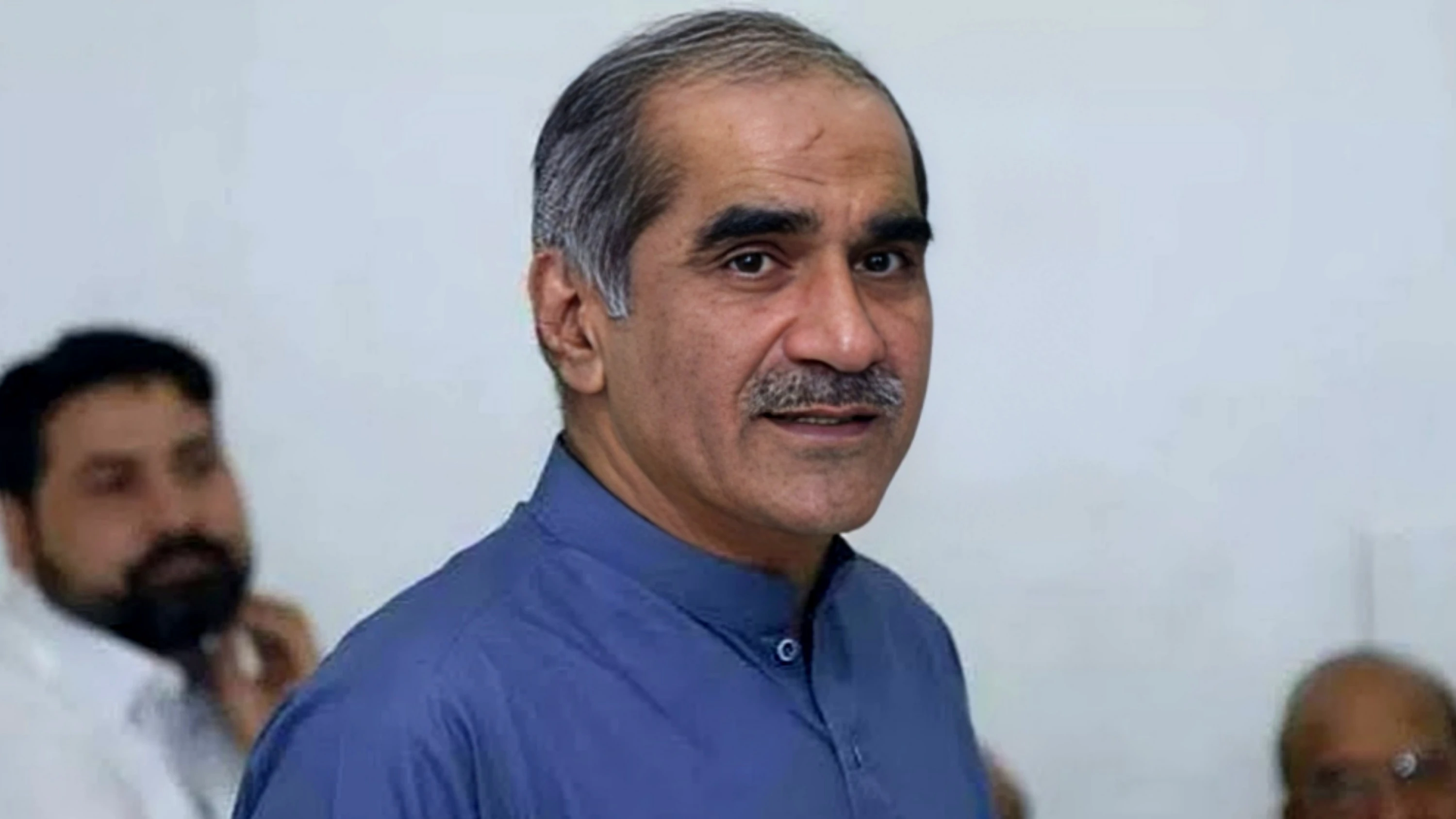

The IMF mission and Pakistani authorities are working on the specifics of these measures, with negotiations set to continue until March 14. The IMF delegation held a "kick-off meeting" on Tuesday with Finance Minister Muhammad Aurangzeb and his team, following preliminary sectoral discussions that began on Monday.

If talks conclude successfully, Pakistan is expected to receive the second tranche of over $1 billion under the $7 billion bailout program.

Finance Minister Muhammad Aurangzeb stated that Pakistan is well-positioned for the first review of the bailout program, which will involve two rounds of negotiations—one at the technical level and another at the policy level.

The 37-month EFF program, finalized in September 2024, was based on the budget approved by Parliament in July. The first tranche of $1.1 billion was disbursed in advance, while the remaining seven equal tranches are scheduled to be released every six months, contingent upon meeting performance criteria, structural benchmarks, and indicative targets.

To meet IMF's fiscal targets, the government had already committed to emergency revenue measures, which would be triggered if revenue collection falls short by an average of 1% over three months. These measures include increased advance income tax on industrial and commercial imports, a 1% hike in withholding tax on supplies, services, and contracts, and a 5% increase in the federal excise duty on beverages.

A senior official involved in IMF review preparations mentioned that while some technical issues delayed certain deadlines, they were addressed within weeks. The performance review covers the first half of the fiscal year (July 1 – December 31, 2024). Although some gaps were initially identified, all missing links have now been covered.

The biggest weakness observed so far has been a revenue shortfall against program targets. However, this has been compensated for through higher-than-expected non-tax revenues, including central bank profits, petroleum levies, and telecom revenues, leading to a primary budget surplus beyond expectations.

For the 2024-25 federal budget, IMF expects nearly 45% of the required fiscal adjustments (approximately 3% of GDP) to come from pre-legislated measures, alongside significant increases in electricity tariffs as part of the new energy policy.

Other structural reforms focus on strengthening the tax system, resolving energy sector constraints, restructuring or privatizing state-owned enterprises, enhancing the operational independence of the central bank, ensuring financial sector stability, and protecting the most vulnerable segments of society.

Ahead of the IMF mission’s visit, the lender reiterated its goal of raising Pakistan’s low tax-to-GDP ratio by 3% by broadening the tax base and improving compliance.

Key focus areas include increasing direct taxes by bringing retailers, property owners, and agricultural income into the tax net, rationalizing personal and corporate income taxes by reducing exemptions and harmonizing rates, expanding the coverage of the Federal Excise Duty, and eliminating tariff exemptions to boost customs revenue.